Power Grid Flexibility Means Thinking Like An Entrepreneur

A Q&A with our renowned hydropower leader, and voice for the hydropower industry as a whole.

Recently, Rick Miller was asked speak at CEATI’s October workshop — a meeting of minds on the economic coordination of hydropower operations and maintenance, with a focus on hydropower’s strategic flexibility to grid reliability. With 40+ years of experience in the industry ranging from operations manager at Duke Energy to leading a hydropower consulting firm to bringing his knowledge and experience to HDR’s power services, Rick has a wealth of hydropower knowledge and foresight to share. Anyone who’s met Rick knows he’s a lifelong champion for hydropower, and not just because it’s his business. Rick understands the physics of hydropower and its integration into grid operations. He understands how it fits into the grid now and in the future. And he understands how to help clients make hydropower profitable in a changing grid.

Q: Why do we need power grid flexibility and fuel diversity, and how does hydropower fit into it?

A: Creating operational flexibility and fuel diversity is the only way to build a stable, reliable grid. With the increased penetration of solar and wind energy supply resources, complementing and dispatchable technologies are needed to accommodate the load following and rapidly changing grid needs occurring daily. The Bonneville Power Administration does this every day with their transmission interconnections and extensive hydropower on the Columbia River.

Additionally, when we get too reliant on one form of power, whether it’s solar, fossil fuel or even hydropower, we’re vulnerable. Right now, in some areas natural gas comprises over 50 percent of energy generated during peak capacity — other areas are approaching 70 percent. If there’s a natural gas shortage due to pipeline infrastructure limitations or heating demands and prices soar, the power supply will likely become scarce and expensive. Single fuel dependency is incredibly risky in terms of resiliency and profitability.

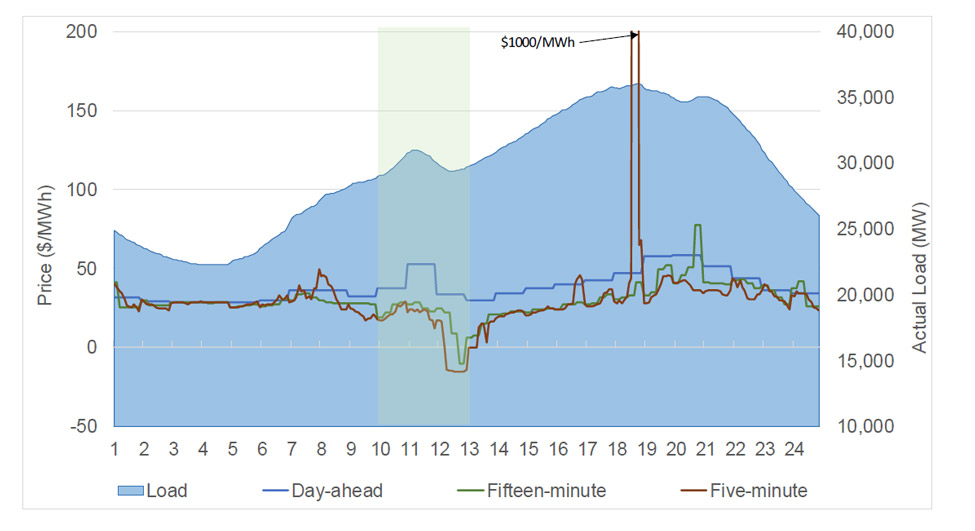

Electricity Cost During 21 August 2017 Solar Eclipse

Another example comes from the solar eclipse in August. California’s power system is relying heavily on solar power, and that reliance is growing. Hydropower and other sources are significant contributors to grid flexibility for integrating that growing solar generation, and that contribution is recognised, when it’s needed. So when the eclipse occurred during the day when demand is high, CAISO looked to other energy sources, including hydro. Because California’s grid isn’t built for unlimited flexibility, they paid a high price for that hydropower — peaking at $1,000 per kilowatt hour. If CAISO had a diverse power portfolio, it would switch to hydropower or another energy source without significant impact to the budget or energy supply during an eclipse (total solar eclipses will occur in the U.S. in 2024 and 2045), or any event that impacts solar availability.

Hydropower adds to reliability because it’s a stable, renewable energy source. But it’s blending hydropower with a mix of solar, wind, natural gas and fossil fuels that creates a resilient, reliable grid.

Q: At the CEATI workshop you stressed the importance of thinking like an entrepreneur to maximise hydro’s benefit. Will you explain that approach?

A: It boils down to operating your generation portfolio to most effectively meet the needs of the grid, often at the disadvantage of efficient energy generation. How can your assets generate consistent profits if energy efficiency is sacrificed? Traditionally, operators have tried to operate their hydropower units at the most efficient point — missing a huge business opportunity to provide system reserves for load following and frequency regulation. If you can increase business tenfold but your equipment wears our more quickly, is it worth it? Yes! The revenue generated by providing strategic flexibility to the grid can fund equipment maintenance, and eventually replacement.

Hydropower asset management is about strategic thinking, planning in a data-driven, analytical manner. If you have the next dollar in your pocket, how do you spend it given the increasing need for flexibility in the future? It’s a different way of valuing your assets in a changing environment, and it sets you up for long-term resiliency. In turn, this entrepreneurial approach makes hydropower more appealing as an energy source to balance out the grid.

Q: Are there example regions that have this model in place and are seeing a benefit?

A: Yes, let’s look at TransAlta, based in Calgary, Alberta, and operating a hydropower fleet in the province. Alberta is an organised market and the TransAlta hydropower fleet provides the bulk of system reserves and frequency regulation to the grid operator, AESO.

TransAlta’s business approach is entrepreneurial and flexible, enabling it to value ancillary services over and above pure energy generation in the Alberta market. For example, TransAlta operates their largest hydro unit, a 190 megawatt machine, at a continuous minimum load of 13 megawatts, and the company offers the reminder of the unit’s capabilities to the AESO reserves market. Generation efficiency at that very low load is certainly sacrificed, but the benefit is significant revenue resulting from the reserve market.

Rick had a few parting words for hydropower owners who are interested in shifting to an entrepreneurial mindset.

It’ll take strong communication, particularly between asset managers and system operators. Start the conversation. Consider bringing in a firm like HDR to help you work through a comprehensive asset management plan for another perspective. It can be really helpful to be privy to lessons learned at facilities across the country. A focus on optimising your portfolio versus your individual units may be better for your system’s economic health. And the North American power grid only gains strength and reliability when hydropower grows its position as a relied upon, significant player.