Top 5 Trends in Implementing Transportation Technology

From Automated Vehicles to AI, Advancements Are Remaking the Way We Move

The transportation industry finds itself at the forefront of a dynamic era marked by unprecedented technological advancements.

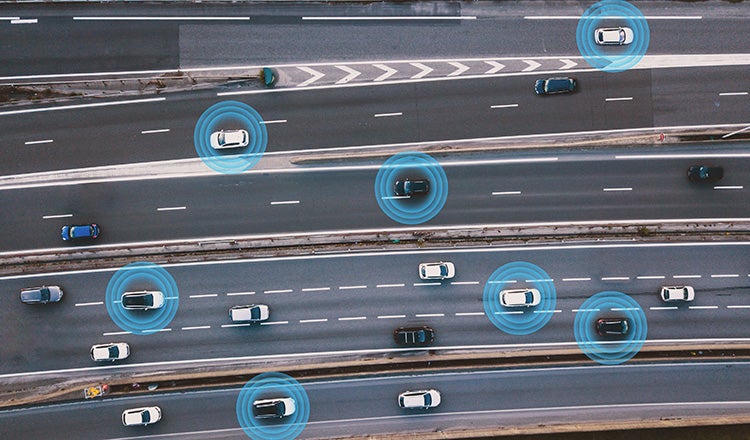

Automated vehicles are reshaping traditional models of transportation, promising enhanced safety and efficiency. Managed lanes are transforming how we conceptualize and utilize road networks, optimizing traffic flow in urban corridors. Electric vehicles are marching inevitably forward, becoming an ever-growing presence on our roads. The implementation of cordon-based congestion pricing heralds a new era in managing urban traffic. And on top of all of this, artificial intelligence and big data are revolutionizing our understanding of transportation systems, empowering leaders to make better informed decisions than ever before.

These trends will transform the transportation industry in the coming months and years. How should the industry respond? Experts Ben Pierce, Rob Mowat and David Ungemah share their views on what’s coming, what it means and how transportation agencies can adeptly navigate these dynamic trends. Together, the five have more than 160 years of experience in the transportation industry and they work daily at the leading edge of today’s smart mobility and emerging technology. In this article they address five key trends:

- The quiet integration of automated vehicles

- The rise of cost-effective managed lanes

- Start of cordon-based congestion pricing

- The inevitability of electric vehicles

- Impact of AI, machine learning and big data

The Quiet Integration of Automated Vehicles

What will happen in the near future?

Drivers will soon be taking their hands off the wheel and their eyes off the road. In some places, it's already happening. While fully automated (Level 5) vehicles are likely still in the distant future, more Level 3 vehicles will be approved soon, and there will be continued growth in sales of automated vehicles at all levels.

Background

Five years ago, fully automated vehicles were being hyped as imminent. Lots of promises were made, a lot of studies were done, and it was the “next big thing.” Then people realized that full automation is actually pretty difficult to achieve. The hype faded. But in the meantime, automation has continued to advance. The Society of Automotive Engineers classifies cars from Level 0 (fully manual) to Level 5 (fully automated). Multiple carmakers now offer Level 2 vehicles that provide advanced steering and acceleration support, with lane centering and adaptive cruise control. And in 2023, Mercedes-Benz rolled out the first Level 3-certified vehicle in the U.S., which takes over all driving tasks in certain conditions. In other words, automated technology is steadily moving forward, though perhaps a little slower than the initial hype suggested.

There is a long way to go before cars can traverse every single roadway in every circumstance on their own. But even at lower levels of automation, the benefits are becoming clear. States and cities should begin to see long-promised safety and congestion improvements, with a steady decline in crash metrics, for example, on roadways that are heavily used by automated vehicles. It will depend on the level of adoption, as well as the readiness of infrastructure. It’s clear, however, that the automated vehicle era has already begun.

How should the industry respond?

- Prepare the road network. Transportation officials need to assess their roadway networks and determine which roads are likely to be part of the use cases for Level 2 and Level 3 vehicles. These are often interstates or four lane divided highways . Once the roads are identified, it’s important to ensure they’re in a good state of repair, with lane striping that is reflective and easy for vehicles to identify. In some cases, perhaps the roadway’s lane striping may need to be widened, for example. Making these facilities easier for automated vehicles to navigate will allow agencies to best capture the benefits that automated vehicles promise.

- Pay attention to available vehicle features. Fleet owners replacing or adding vehicles should stay informed about the latest technology. It’s unlikely that the expense and availability of Level 3 vehicles will make them viable fleet options for the near future. But there are many safety improvements in Level 2 vehicles — adaptive cruise control, collision warnings, blind spot detection — that hold the potential to improve safety metrics for fleet owners. Whether every fleet needs these features depends on how the vehicles are used, but owners interested in improving their fleets should at least be aware of the options available.

- Track performance metrics closely and adapt accordingly. As automated vehicles become more common, North America will be entering a period over the next few years when the transportation industry will be able to quantify the actual impacts of automated vehicles and compare it to what has been predicted. It will be important for departments of transportation and municipalities to pay close attention to changes in crash metrics, congestion levels and more. As agencies see changes, they may be able to adapt facilities. For example, if predictions are confirmed that automated vehicles will be able to safely travel at higher speed in closer proximity to each other, agencies with ramp metering systems may be able to adjust the timing of those systems to reflect the higher capacity that automated vehicles make possible.

The Rise of Cost-Effective Managed Lanes

What will happen in the near future?

Managed lanes will re-emerge as a critically important option for improving travel conditions as the overall cost of implementation declines and enforcement options improve.

Background

Managed lanes are not a new concept. The first priced managed lanes were opened in 1995. In the early days of managed lanes, the technologies and deployments were very similar to those used for tolling. These systems tended to be “infrastructure centric” with costly mechanisms for the collections of fees. In particular, toll roads frequently rely on overhead gantries equipped with RFID readers and overhead cameras to capture front and rear license plate images. If a toll is not collected by transponder, then the license plate capture provides a mechanism for enforcement (or a “pay by plate” alternative). This mechanism not only requires substantial capital equipment for overhead installation, it also entails substantial ongoing operations costs for image review.

In the last few years, though, a necessary and desirable divergence has begun to emerge. New and existing vendors have been refining their technology to appropriately scale toll collection requirements to managed lanes. In short, “infrastructure-light” applications have been introduced that enable fee collection at a much lower operational cost. Colorado was the first state to introduce pole-mounted, side-fire cameras on managed lanes. This eliminated costly overhead gantries dedicated to camera systems. Now, new entrants to the market using machine learning have changed what it means to capture a license plate. Instead of hoping for one good, complete image of the plate, new technology uses a series of camera shots, matched with algorithmic fingerprinting of vehicle characteristics, to yield a license plate image that can be assembled in the cloud, reducing operational costs and enhancing enforcement.

The result is a new technological paradigm that promises more rapid deployment of tolling equipment at a substantially reduced overall capital cost. This could make the difference for marginally viable managed lanes systems and is particularly helpful for agencies exploring and developing their first toll systems.

How should the industry respond?

- Conduct a comprehensive managed lanes system plan. Developing a managed lanes facility that leverages new technologies requires a comprehensive managed lanes system plan. This plan bridges the planning, environmental and systems engineering processes to guide the agency and industry through upcoming managed lanes projects, including their goals and objectives, and the parameters by which decisions will be made. Many states, including Colorado, Minnesota and Florida, have developed such plans that can serve as a go-by for other states.

- Release a Request for Information on new practices for toll collection. Vendors are constantly developing new technologies and procedures for collecting toll revenue. An RFI process gives the state agency a formal pathway for vendors to articulate their technologies as well as advise the agency on procurement requirements, specifications and other instructions that may stand in the way of procuring such systems.

- Eliminate technical specifications and requirements biased toward legacy toll collection systems. When procuring a managed lanes integrator, agencies hinder their opportunity to leverage new systems by being specific or referencing legacy procedures. For example, if an agency details that toll collection should occur on a standard cantilever gantry, then that detail eliminates the option for less costly pole mounted solutions. Agencies must avoid getting too detailed on infrastructure requirements, including overhead gantries, median mounts and other details. Instead, offer system integrators a results-oriented approach that allows the agency to consider alternative technologies in a fair and competitive environment.

- Keep in mind a potential segue to more expansive use of road pricing and road usage charging. As managed lanes become more common, we may begin to see a movement toward greater acceptance of paying for transportation based on facility type, location and demand coupled with visible improvements in travel times, speeds, and mobility. As travelers continue to benefit from priced facilities, they could increasingly support the rationale and benefits of moving away from a revenue model based on the fuel tax to one based on road usage.

Start of Cordon-Based Congestion Pricing

What will happen in the near future?

The New York Central Business District Tolling Program is expected to go live in 2024, introducing the first cordon-based congestion pricing program in North America.

Background

After years of planning and preparation, the MTA Board of Directors voted in November 2023 to advance a tolling structure as recommended by its Traffic Mobility Review Board. This begins the final approval process as required by New York’s State Administrative Procedures Act. Once this process is complete — expected by the end of the first quarter of 2024 — the program will have completed installation of the system’s more than 100 detection points. This will be followed by final system testing and then the beginning of operation in late spring or early summer 2024.

The NYC CBD Tolling Program is unique and will be the first of its kind in many respects. Unlike other tolling programs in North America, the NYC CBD program is not tolling a specific roadway but an area of lower Manhattan. Vehicles entering the toll zone from any roadway will be assessed a fee once per day. Fees are being assessed through a combination of technologies that leverage video and image processing algorithms.

How should the industry respond?

- Explore the new tool in the toolbox. Major urbanized areas with chronic congestion are anxiously waiting to see the results of the New York program to determine the applicability for their own cities. Most mature major urban centers in North America have lost the ability to expand vehicular capacity through expansion of their highway systems. Some form of demand management will be necessary to maintain or improve mobility and to maintain economic vitality. Cities who may be interested in replicating New York’s program should begin planning and discussions now.

- Plan for equity impacts. Congestion tolling cannot be considered without a careful examination of equity impacts. It is viable in NYC because of the strength of the city’s mass-transit system, which is used by most commuters to lower Manhattan. But even with this advantage, careful consideration was required to examine and plan for the impacts on disadvantaged communities. The same will be true of other cities, who should proactively engage communities as part of any work toward congestion tolling.

The Inevitability of Electric Vehicles

What will happen in the near future?

Electric vehicles will continue to be introduced and adopted by consumers. Technologically, there will be advancements in battery performance, vehicle range and connectivity. As companies exit their initial research and development stages and competition increases, vehicle costs will also drop. There will be some fluctuations in demand, but electric vehicles are here to stay and will, over time, replace internal combustion engines as the dominant type of vehicle.

Background

The electric vehicle industry has seen enormous growth in recent years, driven by social action, environmental concerns as well as government regulation. Now that the industry is past the early adoption stage, consumer demand will likely moderate, though it will still be very strong. Electric vehicles have also seen rapid technological change and innovation, with improved range and reliability, as well as new capabilities such as vehicle-to-vehicle or vehicle-to-grid power.

With these advancements and government encouragement, many vehicle fleets have been steadily transitioning to electric vehicles in recent years, and that momentum shows no signs of slowing. Transit agencies have been significant early adopters, but there will also be rising adoptions in sectors such as ports, airports, municipalities, waste haulers and others. With costs dropping, and availability and reliability increasing, more fleet managers will see a viable financial case for making the switch.

As more drivers rely on electric vehicles, charging networks will also necessarily expand. Drivers will be looking for easier ways to take their electric vehicles on vacation or trips, requiring chargers at hotels, in tourism locations, at national parks, etc.

How should the industry respond?

- Start thinking about corridor planning for freight vehicles. Initially, much of the attention has rightfully been on easing the path for passenger vehicles. But electric vehicles are poised to also transform the freight industry. Planning for the needs of these heavy-duty vehicles should be a high priority in the coming years. Much more than just installing chargers at truck stops, this will require complex discussions about energy availability, real estate and capacity. To avoid delaying rollout of these technologies, discussions should be ongoing now.

- Stay apprised of emerging technologies. Fleet owners who have previously dismissed the possibility of electric vehicles should keep themselves aware of the latest in EV technologies. Things that weren't possible a year ago are becoming possible today, and capabilities are changing very rapidly. Barriers to adoption are shrinking as costs fall and range increases. Many fleet operators may find that it now makes sense to consider a transition to electric vehicles.

- Continue community readiness planning. With more electric vehicles in use every day, communities are taking a close look at their readiness. Many questions are being asked: How does my city provide community charging to those without access at their home? What’s the role of the private sector? Why does that neighborhood get a charger and this one doesn’t? Proper EV planning at the city or regional level will be key to ensuring the right policies are in place, particularly to access federal funds as the National Electric Vehicle Infrastructure program continues.

- Update existing transition plans. EV technology has advanced considerably in the last few years. Agencies with existing transition plans for moving to electric vehicles should invest time in reviewing and updating those plans to determine if new and better options now exist.

Impact of AI, Machine Learning and Big Data

What will happen in the near future?

Artificial intelligence will unlock the potential of data by enabling insights previously too labor-intensive or complex to achieve cost-effectively. This will improve traffic management, safety, parking and infrastructure maintenance and help the industry move from reactive to proactive projects.

Background

Over the past decade new data sources have dramatically increased available information. This data has the potential to allow transportation engineers and planners to better plan, design, operate, manage and maintain transportation infrastructure and systems. However, because of the sheer volume of data, transportation professionals have struggled to extract meaningful insights. Now, the added tool of artificial intelligence can be used to efficiently process this tremendous amount of information and gain meaningful insights in a timely manner. We’re already seeing examples of how AI and data are leading to more proactive transportation decisions. Google Green Light applies AI and crowd-sourced data from Google Maps to model signal operations and provide recommendations to optimize traffic flow. Similarly, Axilion X Way uses AI to assess traffic data and provide recommendations to optimize signal operations based on user-selected priorities. And Rekor Command assesses multiple real-time data feeds using AI to enhance traffic management and incident response.

How should the industry respond?

- Keep your eye on the goal. Companies and solutions are popping up everywhere to solve every conceivable problem. While AI holds tremendous promise, it is important to identify the outcome you’re hoping to achieve and prioritize that. Will the AI-based solutions proposed or considered make a meaningful contribution to achieving that benefit? There won’t be any shortage of solutions available; it’s critical to ensure the ones chosen are making the most impact.

- Start with better data. To result in the best insights, AI must have access to the right data. While there are many cloud-based data sources available, they all have limitations. Supplementing this data with traditional data sources such as detector-based data can result in better insights. Once data is gathered, accurate and meaningful AI-driven analytics also requires standard formatting of data. This formatting, combined with sharing public data through a data exchange, will make it much easier for actionable insights to be generated.

- Rethink how data is obtained and analyzed. Traditionally, it has been the practice for organizations to collect, own and analyze their own data. New big data sources, easy access to data through the cloud, and various entities developing AI applications to analyze the data are resulting in changes to how data and insights are accessed. Organizations will have to rethink practices for obtaining data to capitalize on opportunities with third parties. At the same time, standards for those aggregating and analyzing data will need to be in place to ensure quality, as their outputs are increasingly relied upon to operate and maintain critical infrastructure.

For more information, read about our expertise in emerging transportation technologies or contact Mobility & Operational Technology Services Director ben.pierce [at] hdrinc.com (subject: Transportation%20technology%20inquiry) (Ben Pierce).